Navigating Market Storms: Smart Investment Strategies for Every Generation

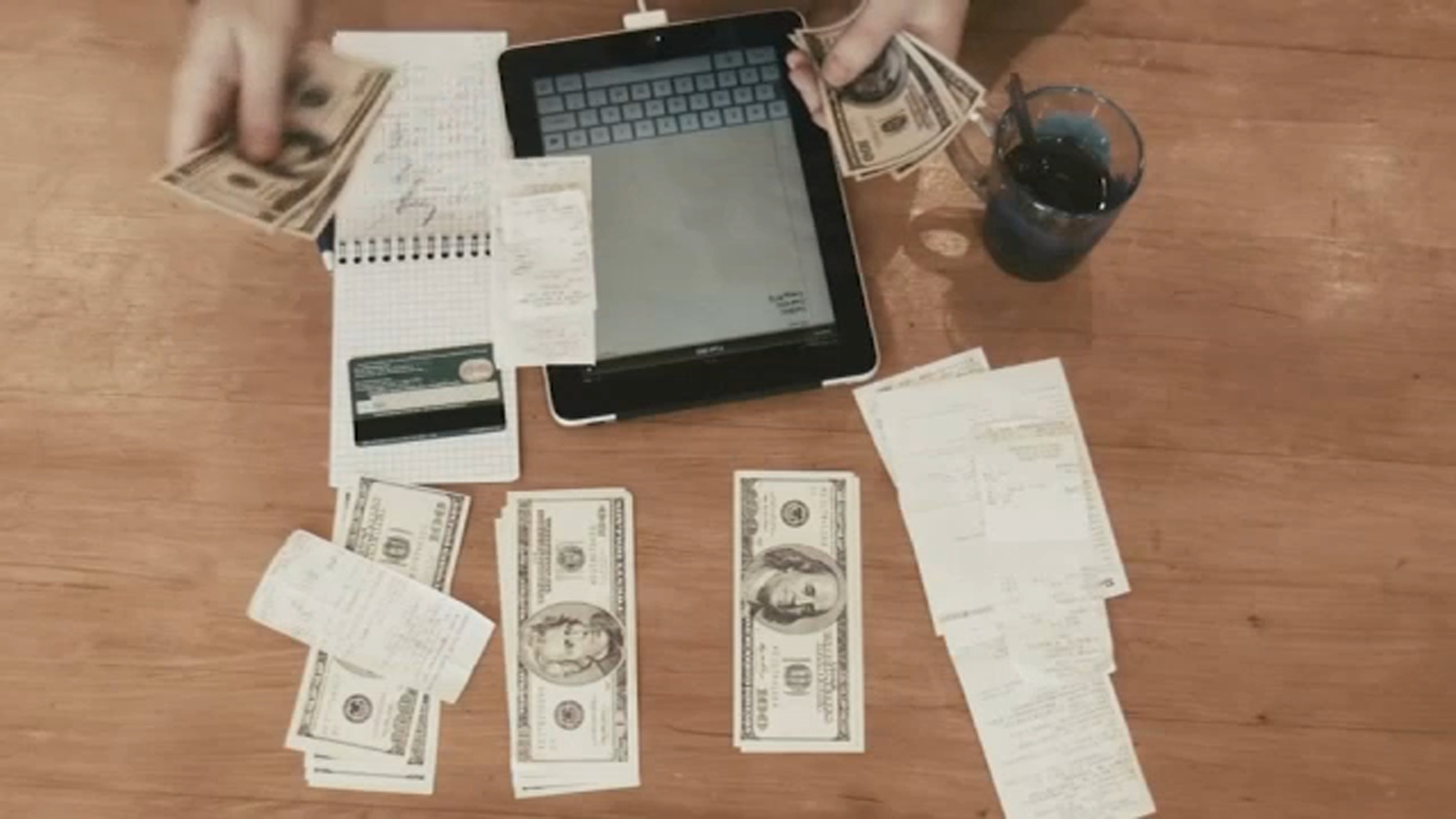

The economic landscape presents unique challenges that ripple differently across generations, with experts highlighting nuanced impacts on both older and younger populations. Financial experts emphasize that the current economic climate is not a one-size-fits-all scenario, but rather a complex tapestry influenced by individual circumstances, financial resources, and personal long-term aspirations.

While younger individuals might face challenges related to career development and initial wealth accumulation, older generations are navigating retirement planning and investment preservation. The divergent experiences underscore the importance of personalized financial strategies that adapt to each age group's specific needs and goals.

Factors such as income level, existing savings, career stage, and personal financial objectives play crucial roles in determining how economic shifts affect different demographic groups. Understanding these variations can help individuals make more informed decisions and develop resilient financial approaches tailored to their unique situations.