BuildDirect Unveils Strong Financial Performance: Q4 and 2024 Earnings Surge Beyond Expectations

In a testament to its financial resilience, the company has achieved another milestone by delivering $2.2 million in adjusted EBITDA for Fiscal 2024. This accomplishment marks an impressive 12 consecutive quarters of positive financial performance, underscoring the organization's strategic management and operational excellence.

The company's commitment to financial efficiency is further highlighted by its gross margin performance. In Fiscal 2024, the gross margin reached 38.7%, representing an 18 basis point increase compared to the previous year. This incremental improvement reflects the company's ability to optimize its operational processes and maintain strong cost control.

A key driver of the company's financial success has been its disciplined approach to managing operating expenses. During Fiscal 2024, total operating expenses were reduced by $2.3 million, dropping to $26.3 million—an 8.0% year-over-year reduction. This significant cost optimization was achieved through strategic operational efficiencies and careful expense management.

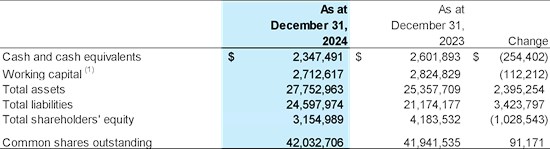

Additionally, the company demonstrated effective working capital management, with a modest decrease of $0.1 million. The working capital stood at $2.7 million as of December 31, 2024, compared to $2.8 million in the previous period, reflecting the organization's prudent financial strategy.