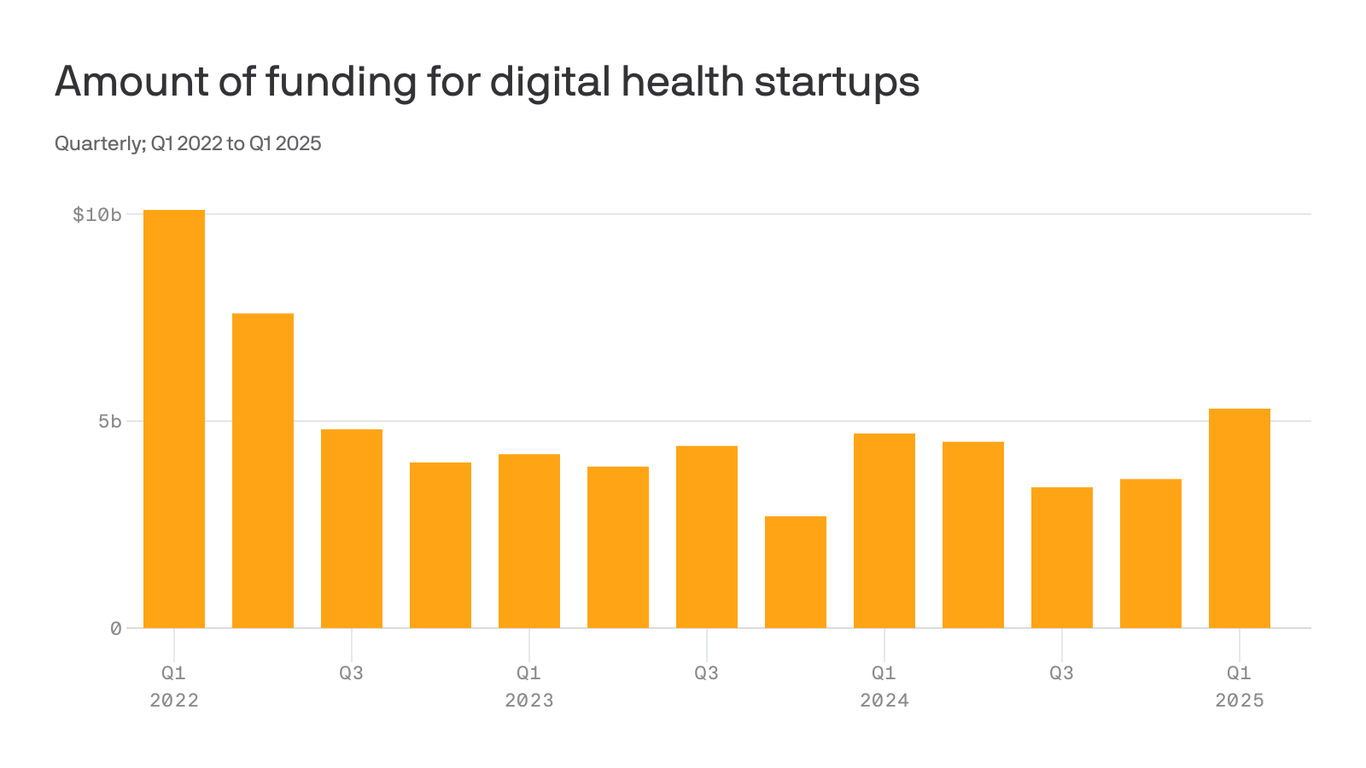

Digital Health Funding Explodes: $5B Surge Signals Tech Revolution in Healthcare

Venture capital firms have just marked a significant milestone in space technology investment, recording the most substantial quarterly funding since the middle of 2022. This surge highlights the continued investor confidence and growing excitement surrounding space exploration and commercial space technologies.

The impressive investment figures underscore the sector's resilience and potential, demonstrating that despite economic uncertainties, investors remain bullish about the future of space-related innovations. From satellite technologies to commercial space missions, the funding reflects a robust and optimistic outlook for the industry's continued growth and technological advancement.

Analysts suggest this investment trend signals a strong belief in the transformative potential of space technologies across various sectors, including telecommunications, earth observation, and emerging commercial space ventures. The substantial financial backing indicates that the space industry is not just a futuristic concept, but a rapidly evolving and economically promising field.