Wall Street Titan Warren Buffett Shrugs Off Market Chaos: 'Just Another Day'

In the rollercoaster world of stock market investing, the S&P 500 has experienced a turbulent ride this year. The index has slipped approximately 3% in 2023, with a particularly dramatic dip that saw it plummet over 19% from its peak historical point. However, for legendary investor Warren Buffett, these market fluctuations are merely another day in the financial landscape.

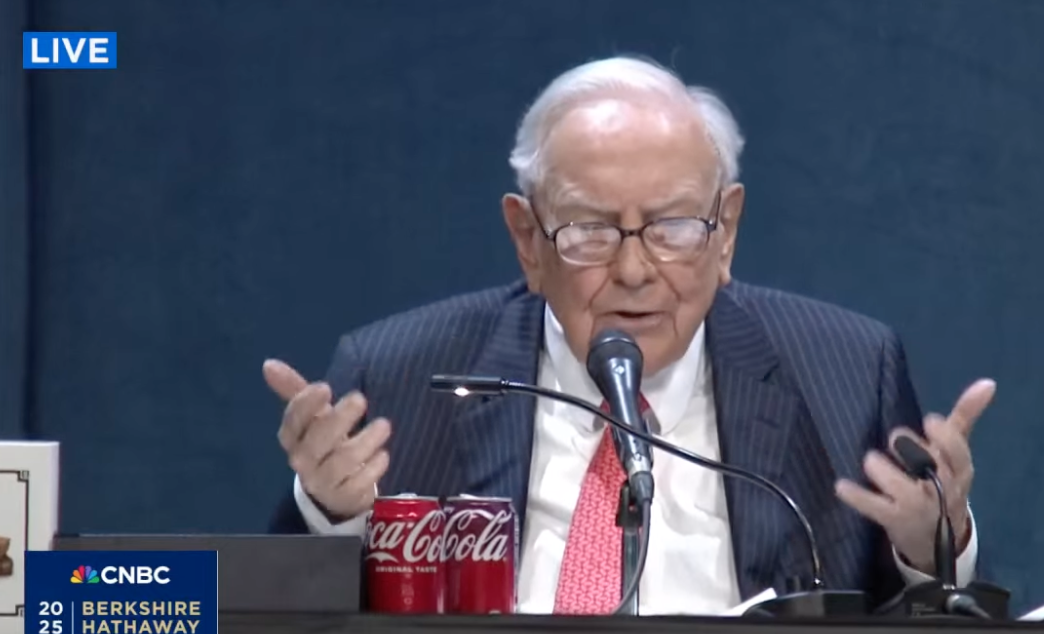

The seasoned billionaire investor, known for his calm demeanor and long-term investment strategy, seems unfazed by the current market volatility. While many investors might be nervously tracking every market movement, Buffett's legendary composure remains unshaken, reflecting his time-tested approach of looking beyond short-term market gyrations and focusing on fundamental value.

This year's market performance serves as a reminder that investing is a marathon, not a sprint, and that resilience and strategic thinking are key to navigating uncertain financial terrain.