Mortgage Minefield: The Hidden Cost Bomb Experts Don't Want You to Know

Financial guru Dave Ramsey has a critical warning for homebuyers: beware of a common mortgage pitfall that could derail your financial future. When shopping for a home loan, many consumers make a costly mistake that can burden them for decades.

Ramsey emphasizes the importance of avoiding adjustable-rate mortgages (ARMs), which might seem attractive initially but can quickly become a financial nightmare. These loans may start with temptingly low interest rates, but they're designed to fluctuate, potentially causing your monthly payments to skyrocket unexpectedly.

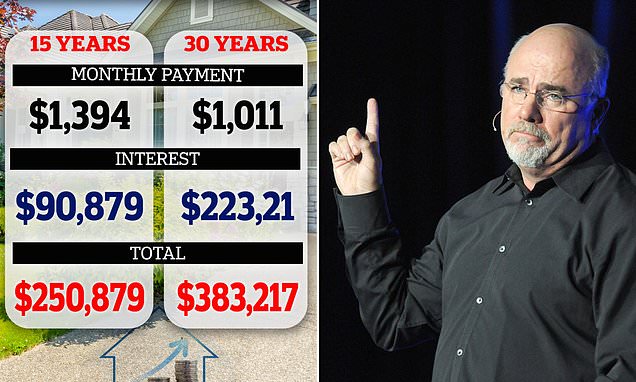

Instead, Ramsey recommends sticking with a traditional 15-year fixed-rate mortgage. This approach offers stability, predictability, and the opportunity to build equity faster. By choosing a fixed-rate mortgage, homebuyers can protect themselves from market volatility and unexpected payment increases.

The key takeaway? Don't be seduced by seemingly low initial rates. Look for a mortgage that provides long-term financial security and peace of mind. A stable, fixed-rate mortgage isn't just a loan—it's a foundation for your financial well-being.

Homebuyers should carefully evaluate their options, consult with financial advisors, and prioritize a mortgage strategy that aligns with their long-term financial goals. Remember, the right mortgage can be a powerful tool in building wealth and securing your financial future.