Money Matters Unveiled: Finance Gurus Tackle Your Burning Questions!

Mastering Your Money: Expert Insights from Neha Kumar

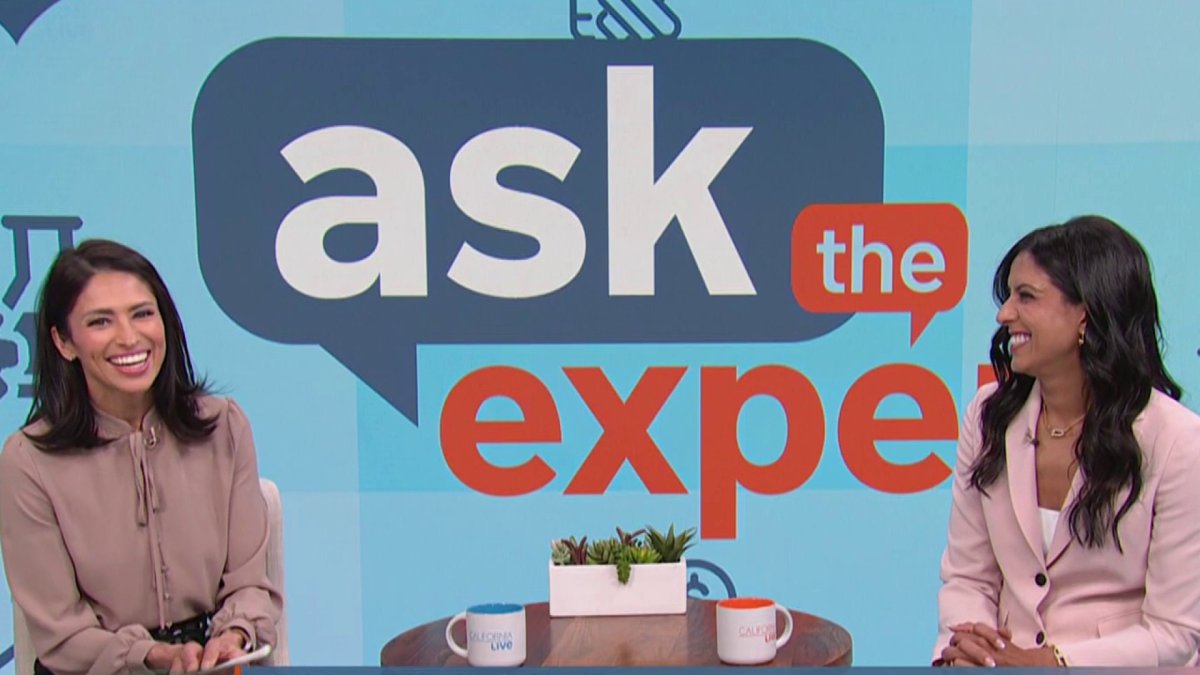

In an exclusive sit-down with California Live's Jessica Vilchis, finance maven and Full Glass Wine Co. co-founder Neha Kumar opens up about the secrets to financial empowerment. With her wealth of industry knowledge, Kumar breaks down complex money matters into actionable advice that can help viewers transform their financial landscape.

From demystifying investment strategies to providing practical tips on savings and debt management, Kumar brings a refreshing and approachable perspective to personal finance. Her mission? To help individuals gain the confidence and control needed to take charge of their financial future.

Whether you're just starting your financial journey or looking to refine your money management skills, Kumar's expert insights offer a roadmap to achieving financial freedom. Join us as we dive deep into the world of smart money moves and learn how to make your cash work harder for you.