Lone Star Dominance: How Texas Outshines Every State in the Business Arena

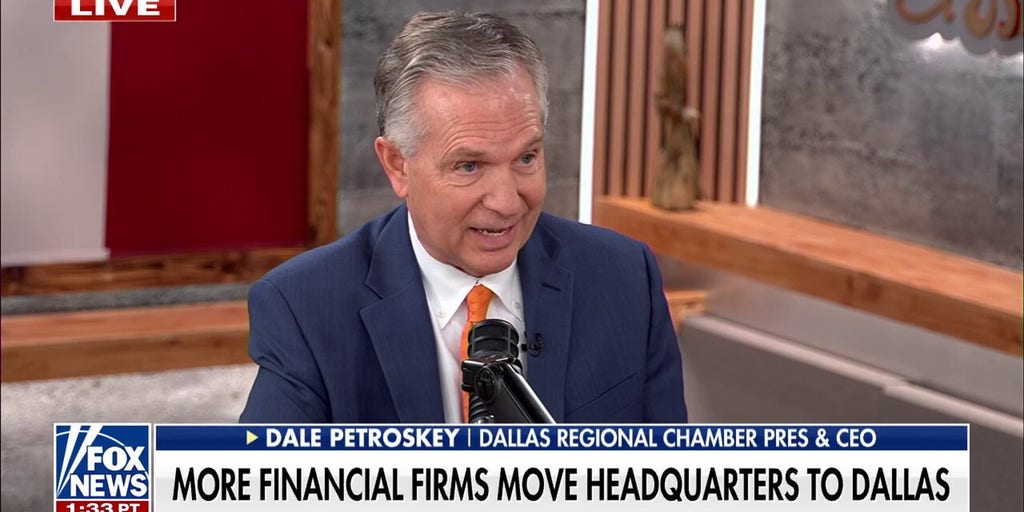

In a recent appearance on 'The Will Cain Show', Dallas Regional Chamber President and CEO Dale Petroskey shed light on why financial firms are increasingly choosing Texas as their headquarters destination. Petroskey offered insights into the state's compelling business environment, highlighting the strategic advantages that are drawing major corporations to the Lone Star State.

Texas has emerged as a magnet for financial institutions, offering a unique combination of business-friendly policies, competitive tax structures, and a robust economic ecosystem. Companies are finding that the state provides not just a location, but a comprehensive platform for growth and innovation. From low regulatory barriers to a talented workforce, Texas presents an attractive landscape for financial firms looking to establish or relocate their headquarters.

Petroskey's comments underscore the state's ongoing transformation into a premier business hub, particularly for the financial sector. The combination of economic opportunity, strategic geographic positioning, and a pro-business climate continues to make Texas an irresistible destination for corporate leadership seeking to optimize their operational strategies.