Global South's Financial Squeeze: Tighter Credit Horizon Looms Larger

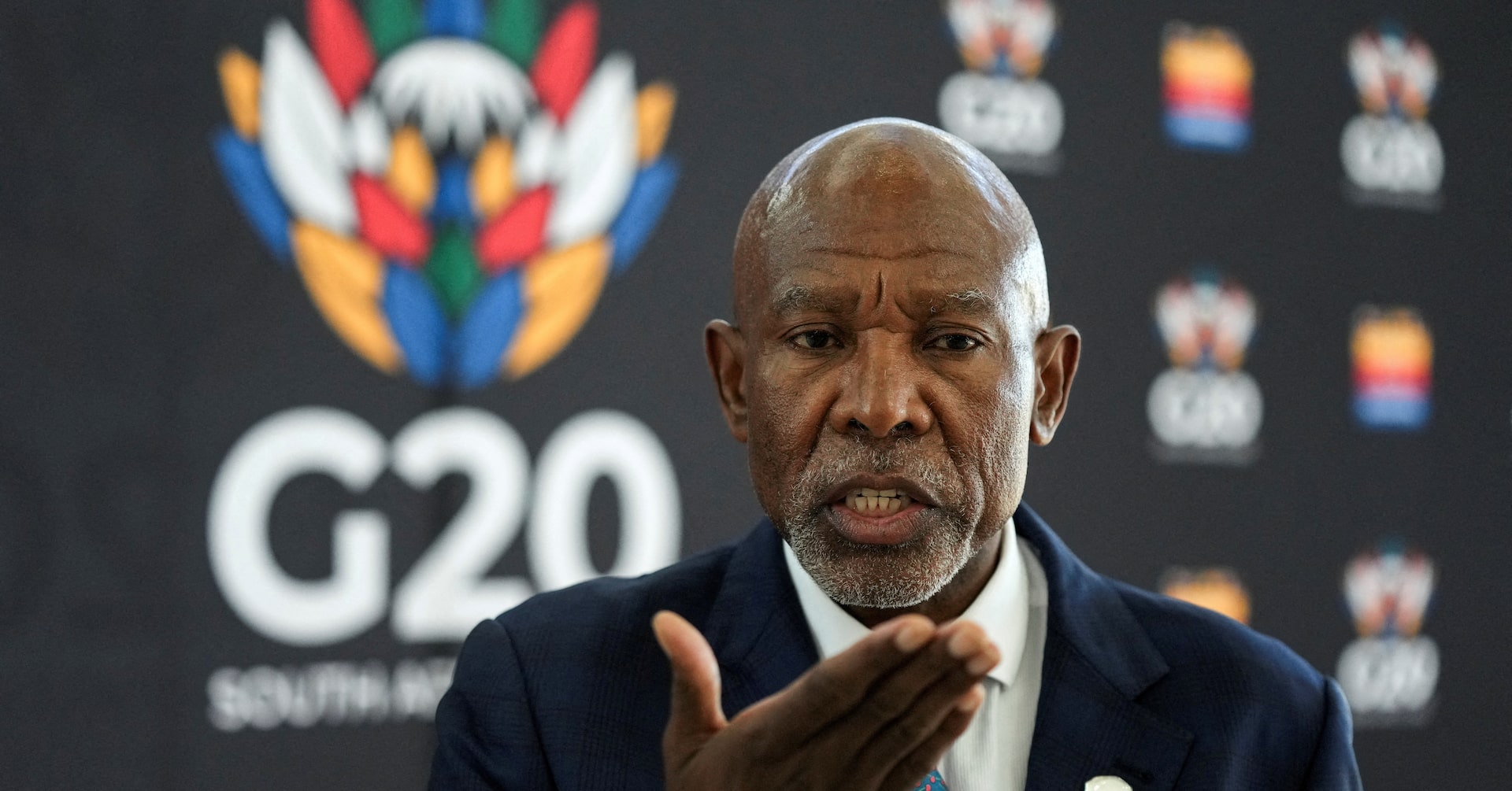

Emerging economies are facing a prolonged challenge as global financial conditions continue to tighten, with central banks worldwide closely monitoring the evolving economic landscape. In an exclusive interview with Reuters, the Governor of South Africa's Reserve Bank highlighted the critical pressures facing developing nations in the current global economic environment.

The financial outlook suggests that emerging markets will need to navigate increasingly complex financing conditions, with particular attention focused on the future of risk-free investment assets. This ongoing economic tension presents significant challenges for countries seeking to maintain financial stability and attract international investment.

As global economic dynamics shift, central bankers are carefully assessing the potential long-term implications for emerging economies, emphasizing the need for strategic financial planning and adaptive monetary policies. The prolonged tightening of global financial conditions underscores the delicate balance these nations must strike between economic growth and financial resilience.