From Theory to Triumph: How Fama and Booth Revolutionized Financial Thinking

In the dynamic world of financial theory, few concepts have been as transformative and controversial as the Efficient Market Hypothesis (EMH). Pioneered by Eugene Fama in the 1960s, this groundbreaking theory fundamentally challenged how investors and economists understand market behavior.

Imagine a financial landscape where every piece of available information is instantly reflected in stock prices. This is the core premise of the Efficient Market Hypothesis. Fama proposed that markets are inherently rational, with stock prices always representing their true intrinsic value based on all known information.

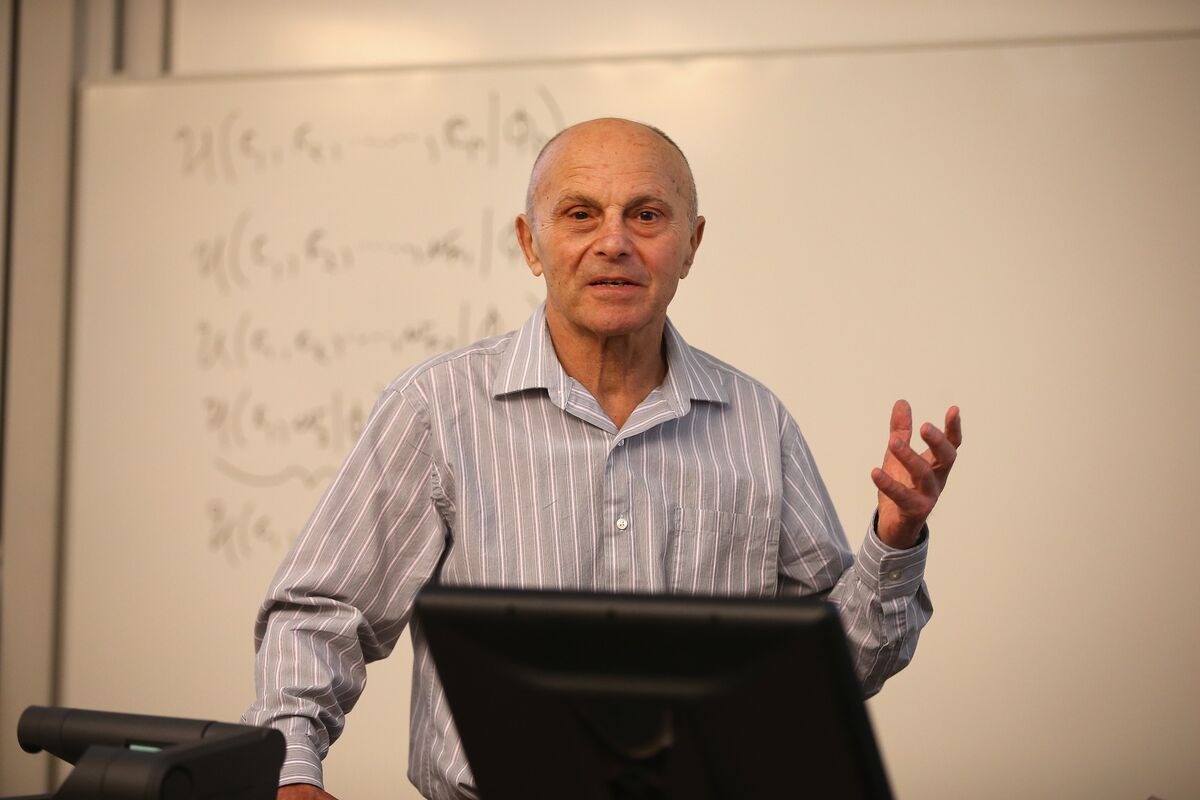

The hypothesis emerged from Fama's doctoral research at the University of Chicago, where he meticulously analyzed stock market patterns. His revolutionary work suggested that trying to consistently "beat the market" through stock picking or timing was essentially futile. According to EMH, markets are so efficient that no investor can systematically outperform them through skill alone.

Fama's theory is typically divided into three forms: weak, semi-strong, and strong. The weak form suggests that past price movements cannot predict future prices. The semi-strong form argues that publicly available information is immediately incorporated into stock prices. The strong form claims that even insider information is reflected in market prices.

While controversial, the Efficient Market Hypothesis profoundly influenced investment strategies, academic research, and financial regulations. It paved the way for index investing and challenged traditional approaches to stock market analysis.

Though not without critics, Fama's hypothesis remains a cornerstone of modern financial economics, continuing to spark debate and inspire further research into market dynamics.