Financial Resilience Rising: Canadians Navigate Economic Storm with Smart Debt Strategies

Financial Caution Sweeps Across Canada: Majority of Canadians Tighten Spending Belts

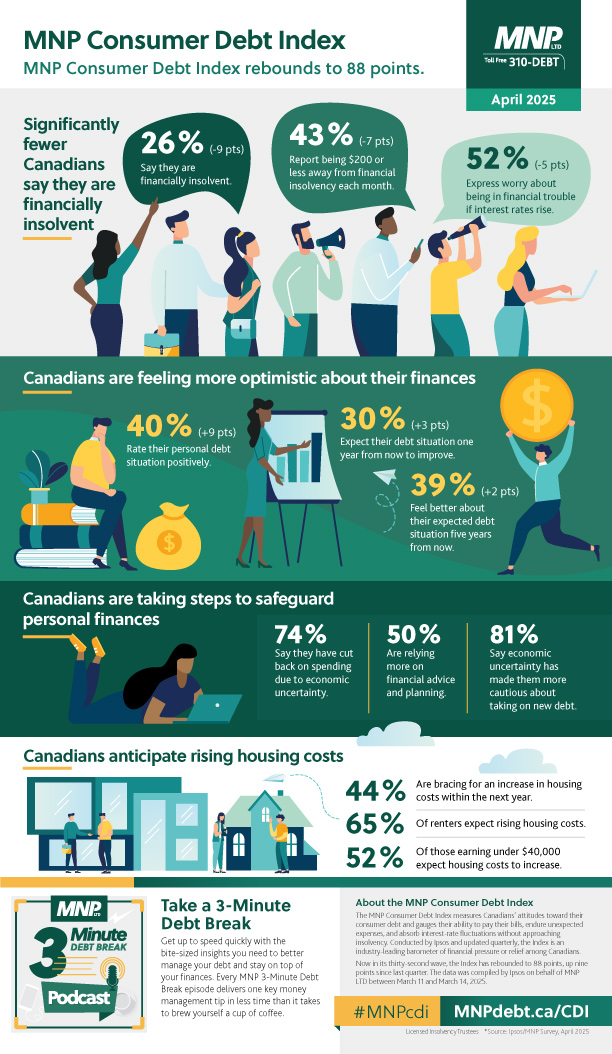

In a striking display of financial prudence, recent data from the MNP Consumer Debt Index reveals that three-quarters of Canadians are taking decisive steps to protect their financial well-being. An impressive 74% have already cut back on spending, while 73% are strategically postponing major purchases in response to economic uncertainties.

The latest index, climbing to 88 points this quarter—a significant nine-point jump from the previous period—suggests a nuanced shift in Canadians' financial outlook. Despite economic challenges, there's an underlying current of cautious optimism among consumers.

Released on April 14, 2025, the report highlights how individuals are proactively managing their financial landscapes. From reducing discretionary expenses to deferring significant investments, Canadians are demonstrating remarkable financial resilience and strategic planning.

This trend underscores a broader narrative of financial adaptability in an ever-changing economic environment, with consumers showing remarkable insight and restraint in their financial decision-making.