Crypto Heist Foiled: Loudoun Detectives Crack $1.4 Million Scam Case

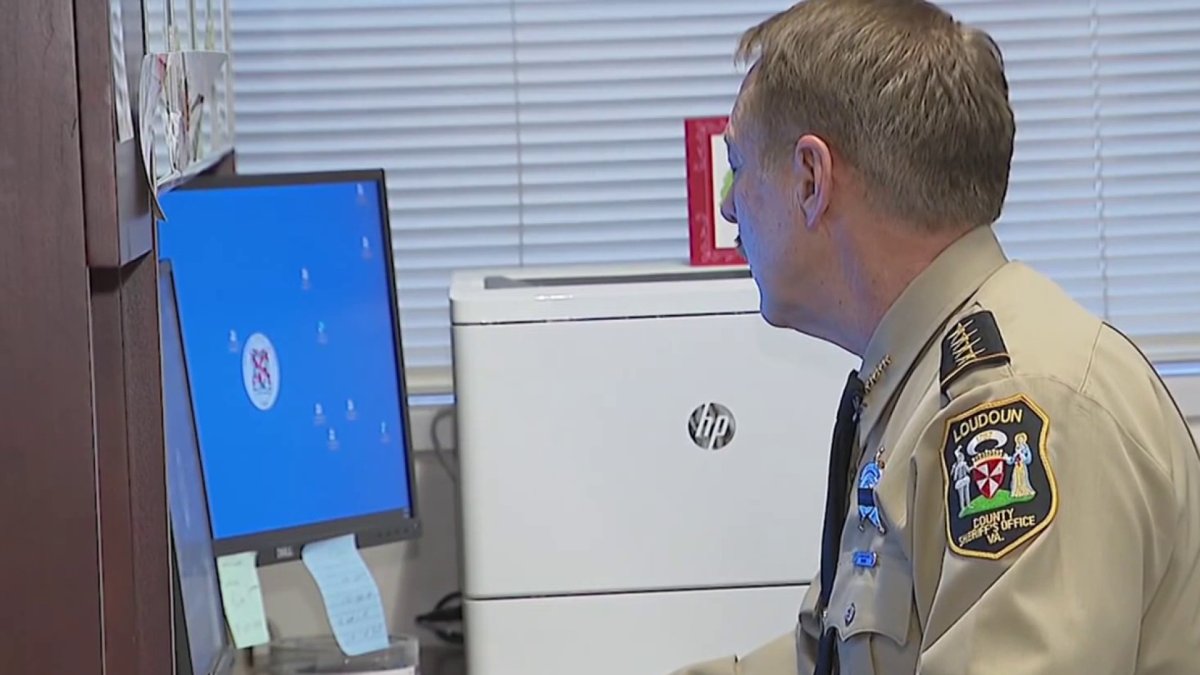

In a remarkable law enforcement success, the Loudoun County Sheriff's Office has recovered over $1 million in cryptocurrency, marking one of the most significant digital asset seizures in Virginia's history. The case centers around a devastating "pig butchering" scam that left a local resident $1.4 million poorer.

This sophisticated financial fraud, known as a pig butchering scam, follows a calculated pattern where cybercriminals meticulously build trust with their victim. Through carefully crafted communication and manipulation, the scammer gradually convinces the target to invest substantial sums of money, only to vanish with the funds once the victim has been thoroughly deceived.

The sheriff's office's successful recovery represents a critical victory against increasingly complex digital financial crimes, offering hope to victims and demonstrating law enforcement's growing capability to track and intercept cryptocurrency-related frauds.

While the details of the investigation remain confidential, this case serves as a stark reminder for individuals to exercise extreme caution when approached with unsolicited investment opportunities, especially those involving cryptocurrency.