Crypto Cash Machines: The Wild West of Digital Fraud Sparks Colorado Crackdown

The cryptocurrency revolution is gaining unprecedented momentum in the United States, with a remarkable surge in cryptocurrency ATMs reflecting the growing mainstream acceptance of digital currencies. As more Americans become intrigued by the potential of blockchain technology and digital assets, the infrastructure supporting cryptocurrency transactions is rapidly expanding.

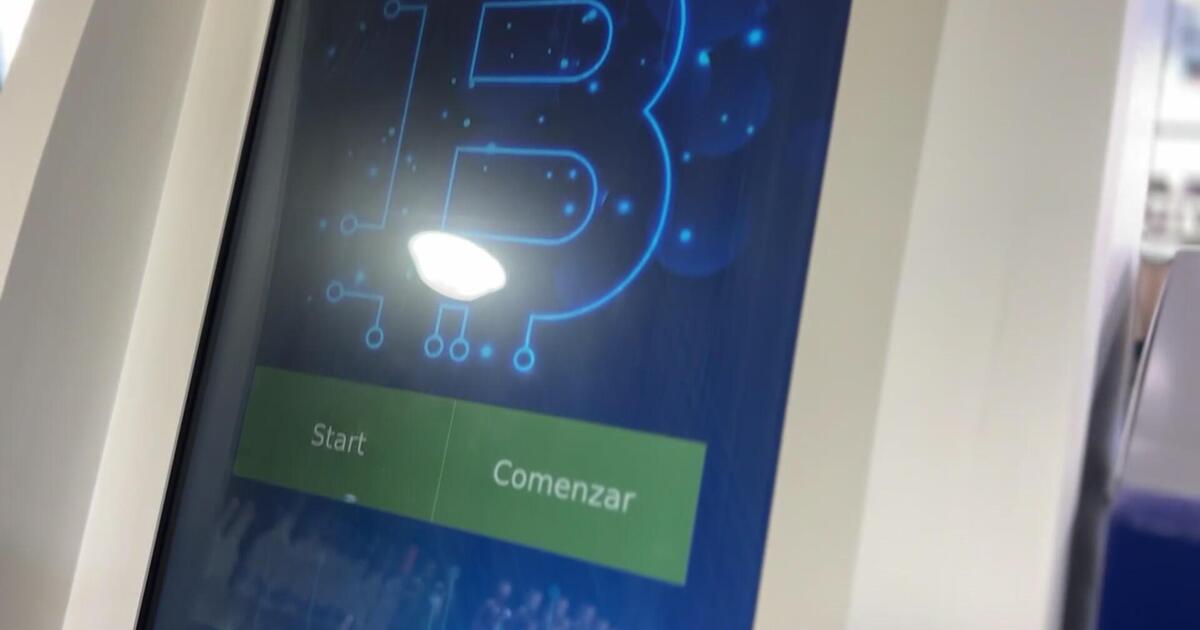

These specialized ATMs are popping up in cities and towns across the nation, making it easier than ever for individuals to buy, sell, and exchange cryptocurrencies like Bitcoin, Ethereum, and other digital tokens. The increasing number of these machines signals a significant shift in how Americans perceive and interact with alternative financial technologies.

From convenience stores to shopping centers, cryptocurrency ATMs are becoming a common sight, offering users a simple and accessible way to enter the world of digital finance. This trend not only demonstrates the growing popularity of cryptocurrencies but also highlights the increasing integration of digital assets into everyday financial transactions.

As the landscape of digital currency continues to evolve, these ATMs represent a crucial bridge between traditional banking and the innovative world of cryptocurrency, making digital assets more approachable and user-friendly for the average consumer.