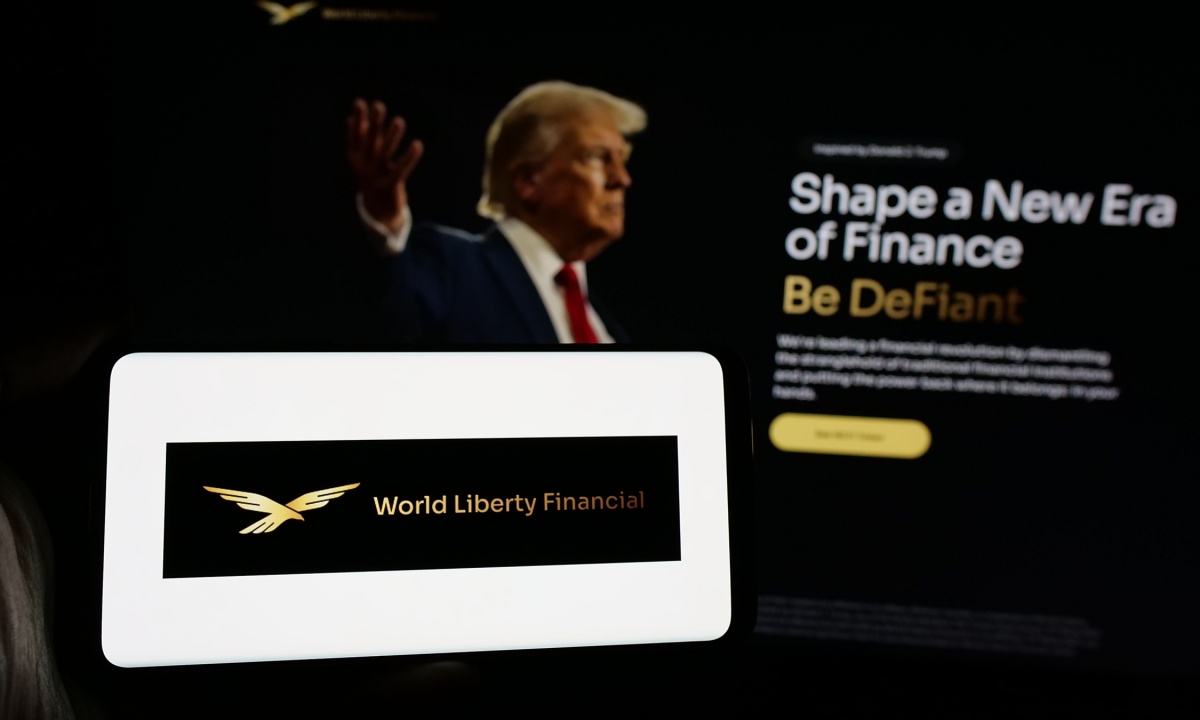

Crypto Boost: Trump-Linked World Liberty Financial Secures Massive $20M Investment

Trump-Linked World Liberty Financial Makes Significant Crypto Investment

In a bold financial move, World Liberty Financial, a firm associated with former President Donald Trump, has reportedly made a substantial investment in the cryptocurrency market. Sources suggest the company has acquired over $20 million worth of digital assets, signaling a growing interest in decentralized finance (DeFi) from the Trump-affiliated organization.

The strategic purchase highlights the increasing mainstream attention to cryptocurrency and blockchain technologies. While specific details about the exact cryptocurrencies purchased remain limited, the sizeable investment indicates a potentially significant move in the digital financial landscape.

This development comes at a time of heightened interest in alternative financial technologies, with more investors and organizations exploring the potential of decentralized financial platforms. World Liberty Financial's investment could be seen as a testament to the growing legitimacy and potential of cryptocurrency investments.

Market analysts are closely watching this move, speculating about the potential implications for both the cryptocurrency market and the broader financial ecosystem.