Capitol Hill's Crypto Gamble: Senators' Secret Digital Wallet Investments Exposed

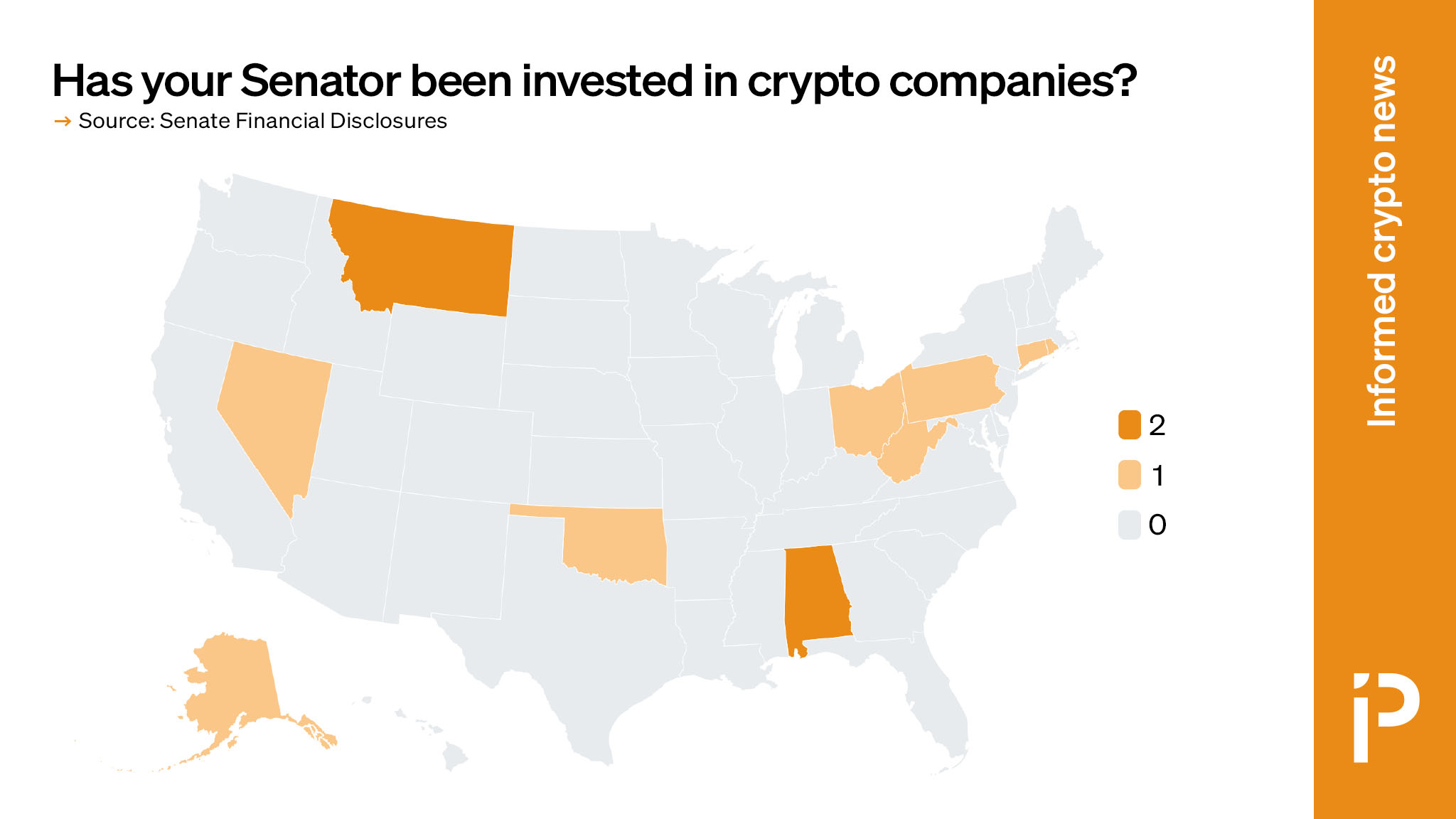

As the cryptocurrency landscape continues to evolve, U.S. senators find themselves at the crossroads of critical legislative discussions. Surprisingly, despite the intense debates surrounding digital assets, many lawmakers appear to have limited personal financial stakes in the crypto industry.

The ongoing legislative conversations about cryptocurrency regulation have sparked intense interest, yet a closer examination reveals an intriguing disconnect. While senators are actively shaping potential policies that could dramatically impact the crypto ecosystem, their personal investment portfolios tell a different story.

This disconnect highlights a complex dynamic in Washington: lawmakers are wrestling with cutting-edge financial technology while maintaining a surprisingly arms-length relationship with crypto investments. The sparse personal investments suggest that many senators are approaching the topic from a regulatory perspective rather than a personal financial interest.

As the debate intensifies, the crypto industry watches closely, understanding that these legislative discussions could fundamentally reshape the future of digital assets in the United States. The senators' measured approach to both regulation and personal investment signals a cautious yet pivotal moment in cryptocurrency's mainstream acceptance.