Buffett's Investment Wisdom: The Moat-Protected Empires That Make Billionaires Rich

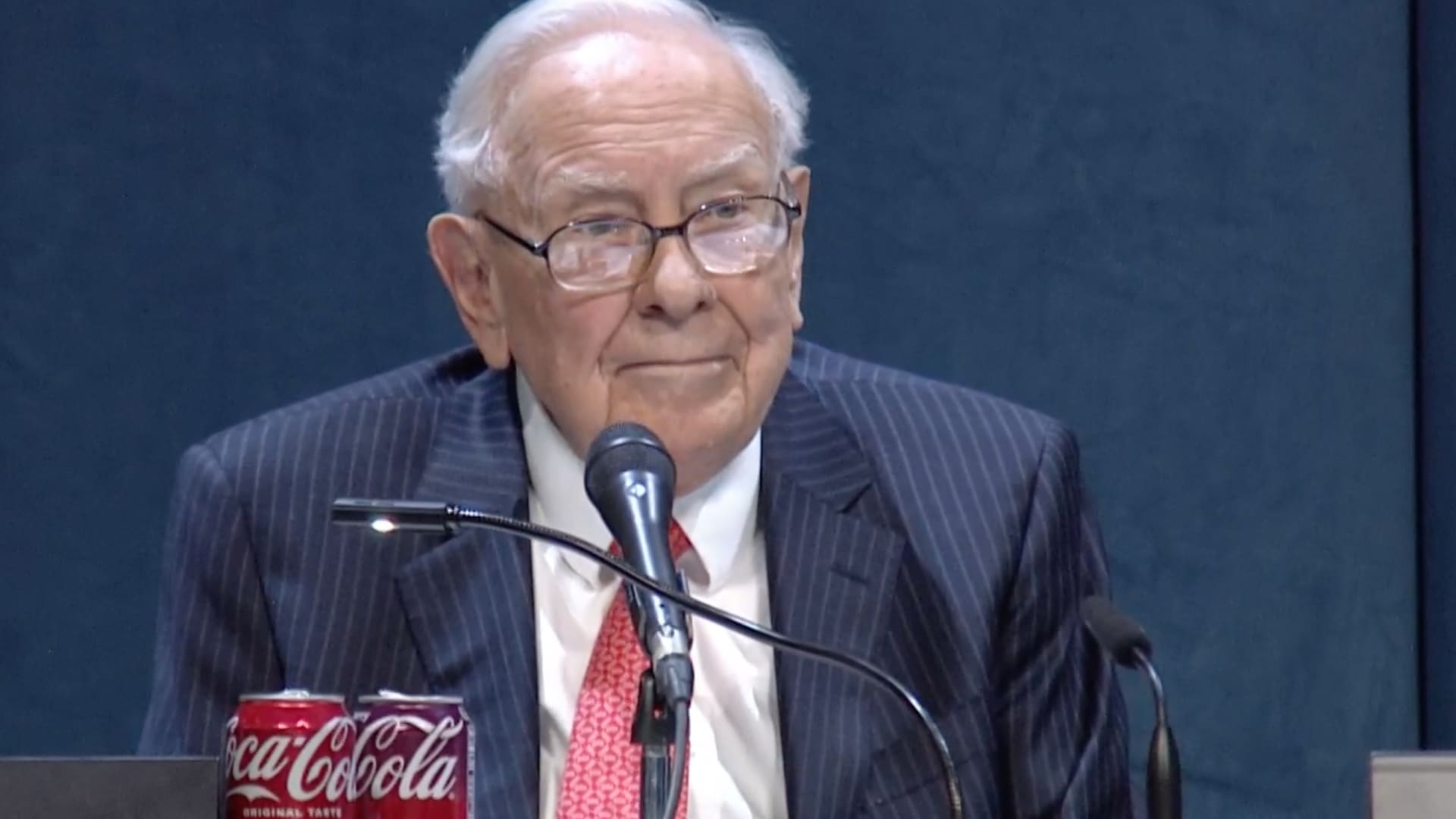

In a landmark announcement that sent ripples through the financial world, Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, revealed his plans to step back from the company he transformed into a global investment powerhouse. Beyond the headline, Buffett's approach to evaluating business health offers a masterclass in strategic investment.

For decades, Buffett has been renowned for his uncanny ability to identify companies with exceptional potential. His secret? A remarkably straightforward yet profound method of assessing a business's true value and sustainability.

When Buffett examines a potential investment, he looks far beyond mere numbers. He seeks businesses with:

• Strong, consistent competitive advantages

• Exceptional management teams

• Clear, sustainable business models

• Robust financial fundamentals

• Long-term growth potential

His famous "moat" concept suggests that the most valuable companies are those with unique barriers that protect them from competitive threats. Whether it's brand strength, technological innovation, or operational efficiency, Buffett looks for enterprises that can maintain their market position over decades.

As he prepares to transition leadership, Buffett's investment philosophy remains a beacon for investors worldwide—a testament to the power of patient, principled investing in an often unpredictable financial landscape.