Breaking: Philly's Bold Move to Slash Business Taxes Could Reshape City's Economic Landscape

Philadelphia's Tax Reform Commission Unveils Strategic Plan to Revitalize City's Economic Landscape

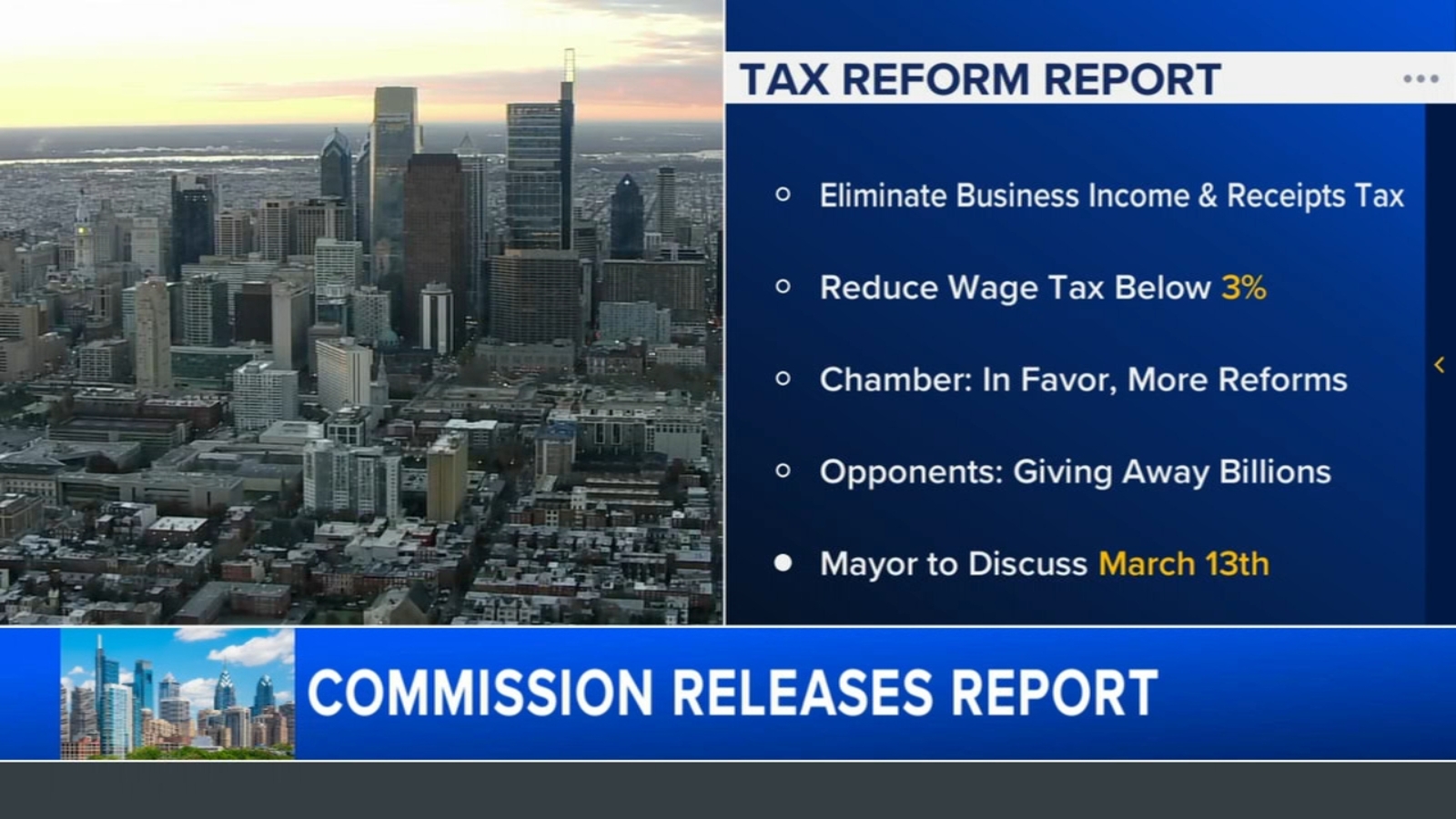

In a bold move to breathe new life into the city's economic ecosystem, Philadelphia's Tax Reform Commission has proposed innovative strategies aimed at attracting residents and boosting municipal revenue. The commission's comprehensive recommendations seek to transform the city's financial dynamics by creating a more appealing urban environment.

Recognizing the challenges of population decline and limited tax base, the commission has developed a multi-faceted approach designed to make Philadelphia more competitive and attractive to potential residents and businesses. Their proposals focus on restructuring tax policies, creating incentives for urban development, and removing barriers that have historically discouraged people from calling the city home.

Key recommendations include potential tax rate adjustments, targeted economic development initiatives, and streamlined processes that could make Philadelphia a more welcoming destination for young professionals, entrepreneurs, and families. By addressing systemic economic challenges, the commission hopes to reverse current trends and position the city as a vibrant, economically dynamic urban center.

The proposed reforms represent a critical step toward reimagining Philadelphia's economic future, balancing the need for increased revenue with creating an environment that encourages growth, innovation, and community development.