Boom in Business Startups: Why Entrepreneurs Are Flooding the Market

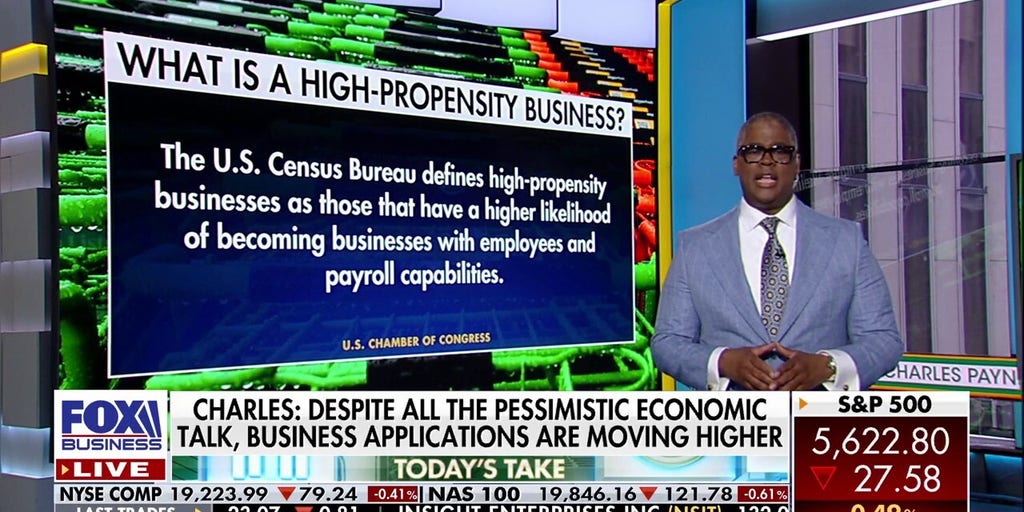

In a passionate defense of the American economic landscape, "Making Money" host Charles Payne delivered a powerful message to investors: never underestimate the resilience and potential of the United States economy. Speaking with conviction, Payne cautioned against the growing trend of betting against American markets and businesses.

Payne emphasized that despite current challenges, the United States remains a powerhouse of innovation, entrepreneurship, and economic dynamism. He argued that investors who short-sell American stocks or predict widespread economic collapse are fundamentally misreading the nation's inherent strengths and adaptability.

Drawing from historical precedents, the financial commentator highlighted how the American economy has consistently demonstrated remarkable recovery and growth, even in the face of significant obstacles. From economic downturns to global disruptions, the United States has repeatedly proven its capacity to reinvent itself and emerge stronger.

"Betting against America is not just a financial mistake," Payne warned, "it's a fundamental misunderstanding of the country's innovative spirit and economic potential." He urged investors to look beyond short-term fluctuations and recognize the long-term value embedded in American markets and companies.

For those seeking smart investment strategies, Payne recommended focusing on sectors driving future growth, supporting domestic businesses, and maintaining a balanced, optimistic perspective on the nation's economic trajectory.