Blue Owl's Strategic Edge: Lipschultz Reveals Winning Formula in Challenging Market

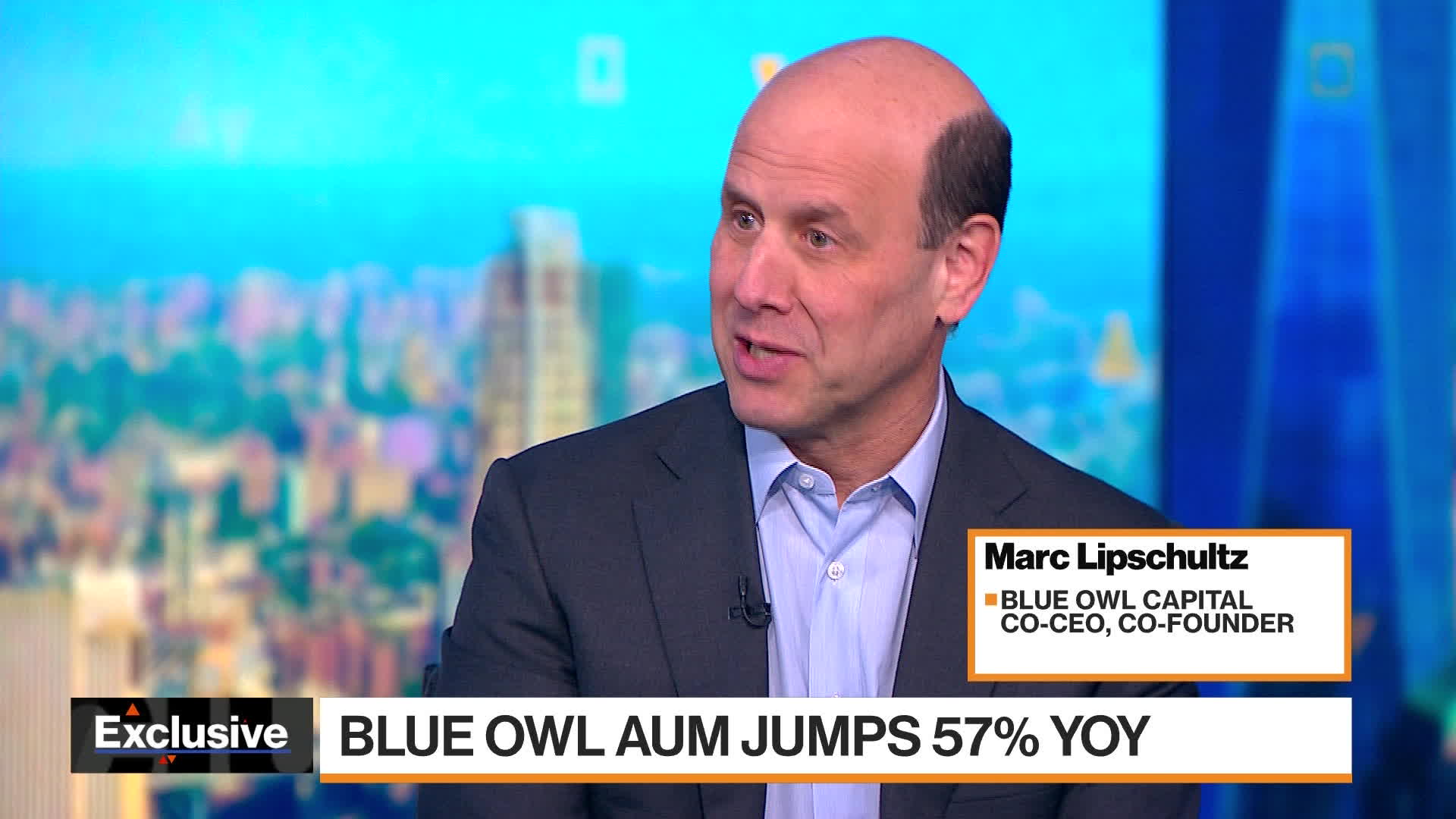

In a recent Bloomberg Television interview, Blue Owl Capital's co-CEO and co-founder Marc Lipschultz confidently asserted that the firm is perfectly positioned to navigate the current market landscape. Lipschultz emphasized the company's strategic alignment with present economic conditions, highlighting Blue Owl's robust approach to investment in challenging times.

The executive's comments underscore Blue Owl Capital's adaptability and strategic foresight, suggesting the firm has deliberately structured its business model to thrive in the current market environment. His statement reflects a strong sense of preparedness and optimism amid economic uncertainties.