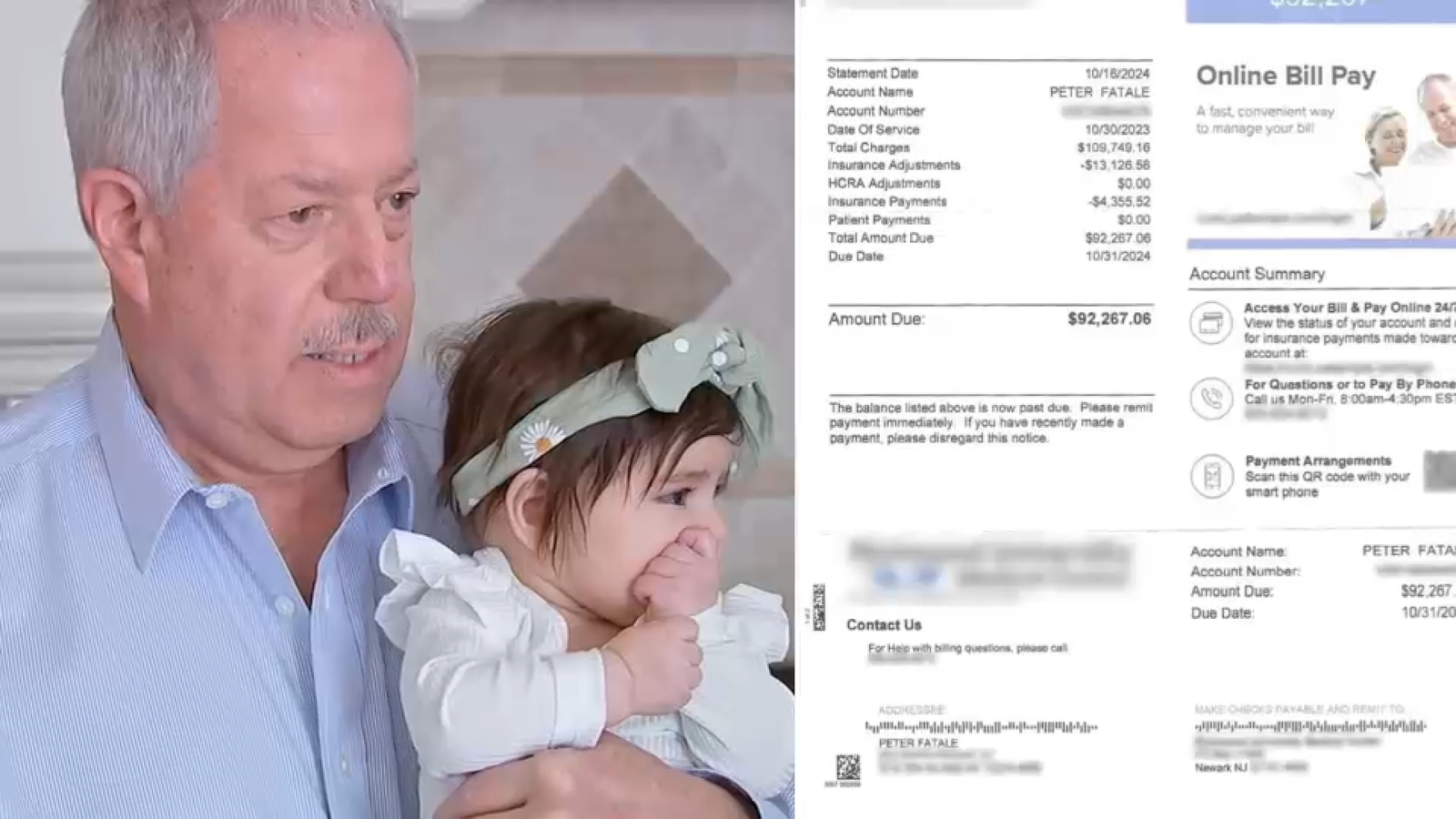

Billing Nightmare Resolved: Consumer Advocate Erases $92,000 Medical Debt After Insurance Blunder

A Staten Island grandfather found himself caught in a frustrating insurance nightmare after undergoing a critical heart procedure that saved his life—only to be confronted with a staggering medical bill that threatened to drain his family's finances.

What should have been a moment of relief and recovery quickly turned into a complex legal battle as two insurance companies engaged in a contentious dispute over who would cover the expensive medical intervention. The elderly resident, who had relied on his insurance for protection, suddenly faced the unexpected stress of potential financial ruin.

The heart procedure, which was essential for his survival, became a catalyst for a bureaucratic tug-of-war that left the grandfather and his family feeling vulnerable and overwhelmed. Caught between competing insurance claims and administrative red tape, he was left wondering how a life-saving medical treatment could transform into such a financial burden.

This challenging situation highlights the intricate and often opaque world of medical billing and insurance coverage, where patients can find themselves trapped in the crossfire of corporate negotiations, despite having diligently maintained their insurance policies.