Banking Boost: RBI's Lending Lifeline Sparks Indian Financial Stocks Rally

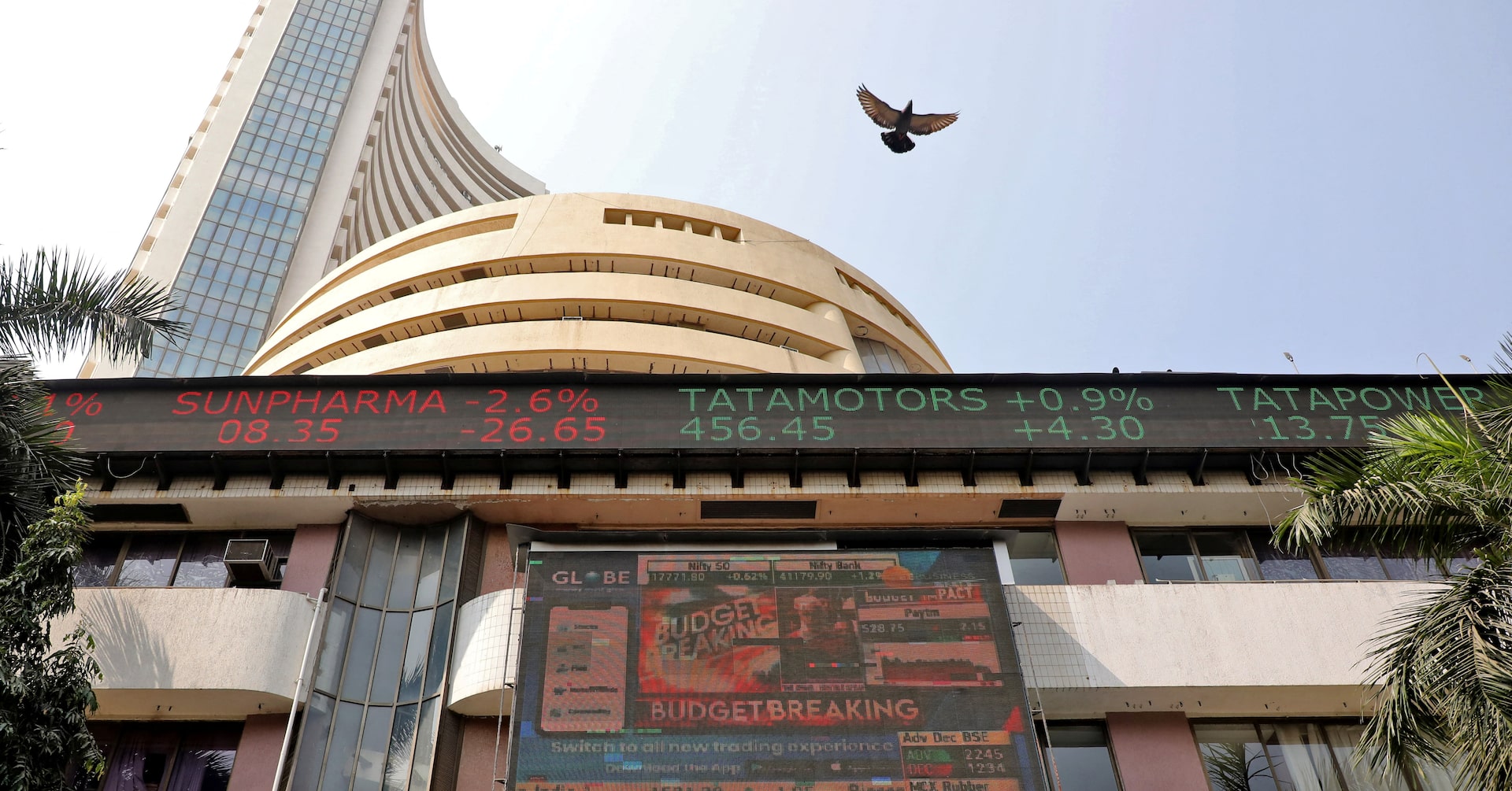

Indian financial markets witnessed a significant surge on Wednesday, with shares of non-bank and microfinance lenders soaring after the Reserve Bank of India (RBI) announced a further relaxation of capital requirements for micro loans and bank credit. The strategic move by the central bank sparked investor enthusiasm and triggered a notable rally in financial stocks.

Investors and market analysts quickly responded to the RBI's policy adjustment, seeing it as a positive signal for the microfinance and lending sector. The eased capital norms are expected to provide more flexibility to financial institutions, potentially boosting their lending capabilities and overall financial performance.

Shares of microfinance companies and non-banking financial corporations (NBFCs) experienced a substantial uptick, reflecting market optimism about the potential growth opportunities created by the central bank's decision. This development suggests a promising outlook for smaller financial institutions that play a crucial role in providing credit to underserved segments of the economy.

The market's positive reaction underscores the significance of the RBI's regulatory approach in supporting financial inclusivity and creating a more dynamic lending ecosystem in India.